Greetings,

Nothing says the world is going back to normal like Wall Street gently “suggesting” that their employees go back to the office to work. Morgan Stanley’s CEO went as far as telling his team that “if you can go to a restaurant in N.Y. City, you can come back to work in the office”. Fortunately, it seems like everyone has migrated to Florida over the last year anyway and there are tons of great restaurants down there so the banks might be in for a bit of a surprise when no one shows up to the office.

We had a full slate this week packed with Canadian and U.S. economic data releases, central bank policy announcements and why not throw in a Canada Housing Trust 5-year issuance for good measure. Before we get to the market reaction, allow me to get you up to speed:

In case you missed it:

Canadian CPI in May increased above consensus to 0.5% month over month and increased to 3.6% year over year bringing us to levels that have not been seen since May 2011. In short: gasoline, housing and vehicles were the largest contributors to the increase – no surprise there. Also, in the category of CPI, Ontario released their guideline on rent increases for 2022 at 1.2% based on Ontario’s YoY CPI data.

Canadian housing statistics for May were released this week showing some signs of easing. For the second consecutive month, the number of home resales declined potentially pointing to buyers finding it more difficult to find suitable and affordable options after months of unsustainable price increases. New listings also slipped but both home and condominium prices continue to escalate.

On Wednesday, the Federal Reserve brought forward their rate hike projections and now expect 2 rate hikes in 2023. Quantitative easing operations remain unchanged however tapering could begin by the end of the year. More on this below.

On Thursday, Canada Housing Trust (“CHT”) launched its regular quarterly 5-year Canada Mortgage Bond (“CMB”). The deal size is expected to be in the range of $5 - $5.25 billion. The bond is expected to price today in the area of the 5-year Government of Canada (“GoC”) bond + 25.5 basis points.

Lastly, just in case you are a week behind (we aren’t judging), the Bank of Canada (“BoC”) had a rate announcement last week and announced … well they didn’t announce much so you are safe to have skipped this one. But July’s meeting could have larger bond market implications so maybe focus your attention over to the BoC on July 14th.

Market Reaction throughout the week:

The following chart is a great summary illustrating the flattening of the curve that we have seen this week. Flattening of the curve implies long-term yields are falling with intermediate maturities (3 – 7 years) rising. The fall in the long-term yields comes after the new forecasts by the U.S. central bank indicating two potential rate hikes by the end of 2023. This has put a check on longer term inflation expectations since higher rates curb inflation and has contributed to the rise in shorter maturities.

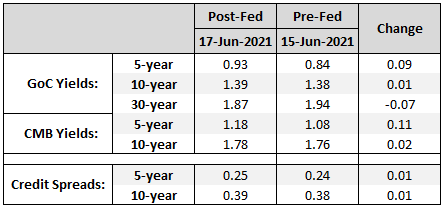

Here is how Canadian rates were impacted by the news:

Canadian credit spreads also took a bit of a hit this week with investors primarily selling the 5-year CMB which was sitting at a very tight spread relative to other Canada Mortgage Bonds along the curve.

What does this mean for you?

For those of you who are eyeing 5-year CMHC deals, it will be interesting to see how the market reacts to the new issuance today. 25.5 basis points over the GoC benchmark bond compared to the 25 basis points that it is trading at now is not a sizeable concession by any means, however, it could be enough to attract investors to buy into the new deal and bring those credit spreads back to the tight levels that we saw earlier this month.

Over to those that may be looking to lock in a 10-year mortgages. The 10-year is trading a little wide at 39 basis points over the benchmark and should demand for this bond pick up (prices up, yields down), we could see a bit of a tightening here as well.

Lastly, this weekend marks the longest day of the year which also happens to be Father’s Day – coincidence? I think not. On that note, I sincerely hope you all have a great weekend and happy Father’s Day to all the dads out there!

Neil