Market Commentary: A catch-up and overview of the markets

- Capital Markets update

- Oct 11, 2024

- Jason Ellis, President and Chief Executive Officer

The rumours of my death have been greatly exaggerated. Treasury Guy is, in fact, alive and well despite the lack of evidence to the contrary. Unfortunately, I’ve been generally distracted by my day job as there isn’t a lot of money in pithy market commentary. Of course, there used to be. I’m not actually the first Treasury Guy. The one before me had grown so rich that he took me aside, told me his real name was Cummerbund, and that I would inherit the role from him. He has been retired for some time and is living like a king in Patagonia.

In any event, much has happened recently. Let me explain. No, there is too much. Let me sum up.

Rates catch up

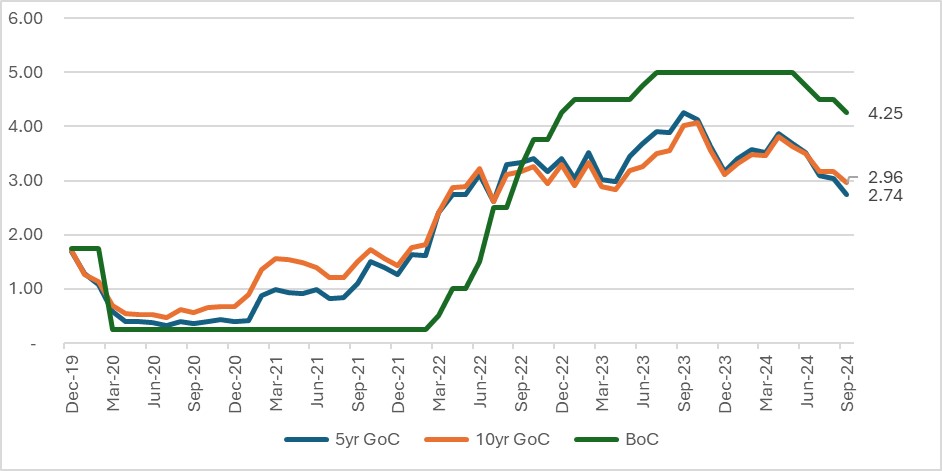

OK, it’s been a minute since we did this, so to provide context and a reminder of where we’ve been relative to where we are, I’ve attached a 5-year yield history for the 5- and 10-year Government of Canada bonds along with the BoC overnight rate. (I made it myself!)

You’ll recall that 5 and 10-year yields hit their lows in July 2020 at 0.32% and 0.46% respectively. By that point the BoC had already cut the overnight rate 150 basis points from 1.75% down to 0.25%, where it would remain until March of 2022, by which time, toilet paper was once again widely available.

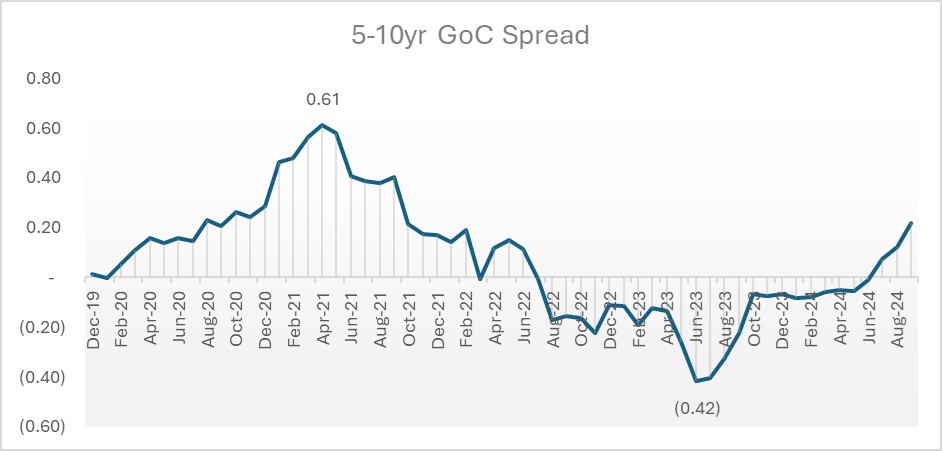

During this period of extremely accommodative monetary policy, the 5–10-year curve steepened reaching it’s widest at 0.61% in April of 2021. See below.

As we emerged from the pandemic and the spectre of a zombie apocalypse, the impact of monetary policy began to show itself in the form of inflation. By February of 2022, 5 and 10-year bond yields were up to 1.60% and 1.80% respectively with growing expectations of a reversal in BoC policy to address inflation.

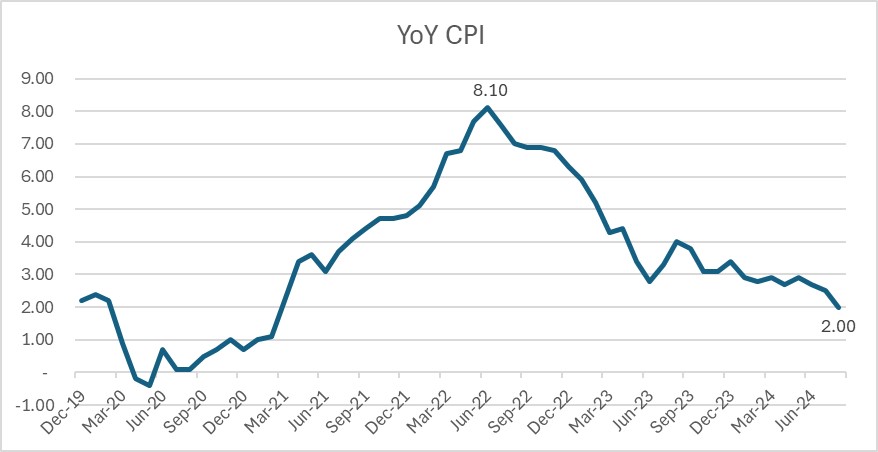

By July 2022, just six months after the BoC started its campaign to raise rates, 5 and 10-year yields were up another 100 basis points to 2.60% and were set to invert (a negative slope between 5-year yields and 10-year yields). The bank was only halfway through its tightening cycle and the pending inversion was a harbinger of a recession on the horizon as an increasingly hawkish central bank was very concerned with inflation, which was peaking around 8.0% in the summer of 2022.

A year later, in July 2023, the Bank reached the end of its hiking cycle having taken overnight rates from 0.25% to 5.00% and the inversion between 5’s and 10’s reached it’s widest point of negative 42 basis points. Needless to say, we were originating a lot of 10-year term commercial mortgages at the time. In the months that followed, bonds reached their highest levels with 5’s peaking around 4.25% and 10’s around 4.10%.

As we rolled into 2024 the Bank’s policy action was duly reflected in the inflation data. Year-over-year CPI in August had finally fallen to the Bank’s target of 2.00% and the unicorn scenario of a soft landing for the economy seemed possible. (See the CPI history below).

That brings us to the end of September. 5s were trading around 2.74% and 10’s were around 2.96% as visions of more rate cuts danced in traders heads. As those of you still reading this monstrosity of commentary will have noticed, the spread between 10’s and 5’s normalized during the summer (possible evidence of the soft landing).

In the meantime, however, US Non-Farm payrolls came in hot last week and yields jumped 25bps. Further frustrating matters, US inflation data yesterday came in hotter than expected suggesting that the Fed may need to pause after their initial 50bp cut last month. At close of business yesterday, 5’s were 3.02% and 10’s were 3.23%.

OK. We’re all caught up. What happens next? I don’t know. I’m no longer young enough to know everything.

Magic 8-Ball

Of course, I don’t get paid the big bucks to tell you where rates have been. You want to know whare rates will go. Will rates continue to fall? After consulting the limited-edition Treasury Guy 8-ball, the answer is: Ask again later. Alas, my financial forecasting tends to be flexible and data dependent anyway.

We can, however, consult the aggregate wisdom of the capital markets that is reflected in the money market to see the future.

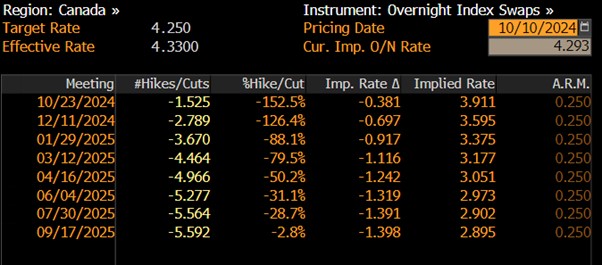

Based on overnight index swaps, the market expects the BoC to cut at least 25bps at the next meeting on October 23rd with a 75% chance of 50bps. Looking further ahead, by the end of March 2025, the market is currently pricing in more than 100bps. The implied probability table is below. Don’t overthink it though, like all things, these implied probabilities change with time. That said, it’s better to be roughly right than precisely wrong.

Changes to mortgage default insurance etc.

30-year amortization

In June, the Government announced that it will allow 30-year amortization for first time home buyers purchasing a newly constructed home. The additional five years of amortization would, however, attract a 20bps insurance premium surcharge.

In September, the Government announced that access to the 30-year amortization would be expanded to include ALL borrowers purchasing newly constructed homes and to ALL first-time home buyers, including those purchasing existing homes.

You’ll recall that the maximum amortization for insured mortgages was reduced from 30 years to 25 years in June of 2012. You might also remember that prior to July 2008, insured amortization ran as long as 40 years with 0% down payment. Those were the days...

Insured mortgage cap

Also in September, the government announced that it would raise the insured mortgage purchase price cap from $1.0 million to $1.5 million, expanding access to high ratio insurance for Canadians in higher priced markets.

No doubt, the lower down payment afforded by default insurance will make properties priced above $1million more accessible, but the practical impact may ultimately be limited by the simple fact that a mortgage in the context of $1.25 million requires income in excess of $275,000 to meet a traditional 39% GDS at today’s rates (including stress test with a 25-year amortization).

The unintended consequence is that properties currently priced in the ‘Goldilocks’ zone of $900,000-$999,000 probably jump 10% in price as the addressable market for insured mortgages expands with the new cap.

Secondary suites

On October 8th, the government released details for lenders and insurers to offer insured mortgage refinancing to enable homeowners to add rental units to their homes. You’ll recall that in October of 2016, refinances (at any LTV) were eliminated from eligibility for default insurance. You may also recall that until April 2010, you could purchase default insurance on ANY refinance up to 95% LTV. Those were the days...

- Eligible borrowers must already own their property, and it must be currently occupied by the borrower or a close relative and the additional unit(s) must not be used as a short-term rental.

- The units must be fully self-contained and meet municipal zoning requirements.

- The ‘as improved’ value of the eligible residential property must be less than $2 million.

- Maximum LTV of 90% of the ‘as improved’ property value (including any other loans secured by the property).

- Maximum amortization of 30 years.

- Additional financing cannot exceed project costs.

- The effective date is January 15, 2025.

Commercial multi-family insurance

I’d hate for our commercial mortgage readers to feel left out...

In June, CMHC announced several changes to its Multi-Unit Mortgage Loan Insurance program including:

- The removal of measures put in place in May 2020 restricting the use of refinance proceeds.

- Changes to the application of Energy Efficiency metrics to qualify for the MLI Select program such that the maximum benefits under the program will be tilted toward affordability.

- Amortization for new construction projects in the MLI Market program extended from 40 years to 50 years.

- Changes to the Approved Correspondent program will no longer allow Mortgage Brokers to submit multi-unit applications directly to CMHC under the name of an Approved Lender. Only Approved Lenders will now be permitted to submit applications directly to CMHC. Brokers and Borrowers will likely need to obtain quotes and select a lender BEFORE obtaining CMHC approval, giving CMHC clarity on who the lender will be that ultimately funds the loan.

Canada Mortgage Bond

In recent quarters, NHA MBS pools of CMHC insured multi-unit residential properties have filled a larger and larger portion of both the 5 and 10-year CMB issuance. Developments like priority allocation for affordability linked multi-family pools has contributed to this phenomenon.

In order to ensure a ‘traditional’ amount of funding is available to sellers of 5-year single family mortgage pools (IE: aggregators), the CMB issue in December will feature a special allocation exclusively for funding single family pool types.

Commercial mortgage borrowers who are now looking for 5-year terms due to the above-mentioned normalizing of the yield curve between 5s and 10s, will have surely noticed that this change to allocation methodology has added to the scarcity value of 5-year money for multis.

This week’s TOP TIP

Have a great long weekend! Have fun storming’ the castle...or whatever you have planned. Enjoy your turkey, ham, or MLT (Mutton, Lettuce and Tomato sandwich), as the case may be.

Sign up for Market updates

Looking for advice and insights on commercial real estate? Sign up today for the Market Update email.

Related Articles

- Policy and advocacy outlook for 2026: Q&A with Tony Irwin, President of Rental Housing Canada

- The Bank of Canada maintains interest rate policy to end 2025

- A First National Quarterly Update from Jeremy Wedgbury

- On the Radar: US Fed Turns Dovish While The Bank of Canada Stands Pat

- On the Radar: December Rate Cut Odds Plummet as the U.S. Fed and BoC Turn More Cautious

- The CMB Upsize and Open Door for Further Exciting Developments